Alpha click link to enter your personal account. Alfa-Bank Business Online - login to your personal account

When logging into the system for the first time, an SMS with a temporary password will allow you to access the settings. The first action in this case will definitely be changing temporary password on new. You can change combinations in the settings more than once.

Alfa-Link Albo will indicate the need to change the password and may not continue to work without this manipulation.

There are no special requirements for the computer from which you log into your personal account. Users of MS Windows and MacOS operating systems can work with it. In this case, various browsers are suitable - Explorer, Opera, Mozilla Firefox. You just need to check the freshness of the installed version.

Also, for work you will need a mobile phone, which will receive SMS codes, and access to the Internet (in particular, to the official website of the bank - link.alfabank.ru).

How to recover your password

You can change or restore your password for logging into your account:

If there is a need to change the phone number to which SMS electronic signature codes are sent, this can only be done by contacting one of the branches of Alfa-Bank (including through a personal manager).

Features of Alfa-Bank personal account

Credit module inAlbono, accordingly, you cannot apply for and receive a new loan remotely. To fill out an application, you must contact the office. But as part of expense transactions, the client can make repayment of existing loans. If payments are periodic, it is possible to create templates.

Using Internet banking as a tool for exchanging data with the bank, you can send inquiries for the provision of credit products or for changing the parameters of existing ones. For example, you can draw up an application for the issuance of the next tranche under a revolving credit line agreement.

Using the Alfa-Bank system, a client - a legal entity or individual entrepreneur - will have the opportunity to:

- Make payments on ruble and foreign currency accounts and receive statements.

- Conduct conversion operations with foreign currency.

- Make payments using prepared documents from 1C, and upload statements to 1C to be reflected in accounting.

- Submit applications for cash withdrawal at the Alfa-Bank cash desk or send letters of a different nature.

The fight against such a phenomenon as cashing out of funds is implemented by banks through various measures and tools. Thus, individual withdrawal limits, tariffs for cash transactions and others are among such measures. Before you start working on your personal profile, you need to carefully study the nuances in this part of cash management services.

Using Alfa-Bank cards as salary cards, the client can make payments to employees both individually and according to the general register.

When preparing payment documents for expense transactions, these transactions are certified by an Electronic Digital Signature (EDS). The same digital signature can be used to sign any other documents sent to the bank. Ordering certificates and statements, requests for unclear payments and other documents certified using an electronic digital signature have the same legal force as papers submitted and signed in person at a bank branch.

Using one login, you can manage accounts of several organizations simultaneously and accounts in different currencies of the same company.

If your business partners are also clients of Alfa-Bank, then through Albo you can:

- Check the business reputation of the counterparty.

- Send a notification, letter or request (the system works similar to a business chat).

- Configure the ability to send SMS notifications to recipients of sent funds.

Mobile version of online banking

The mobile application is adapted for smartphones and tablets. The program is provided to customers free of charge and runs on iOS or Android OS. You can download it from the official App Store and Google Play stores.

The application option will allow:

- exchange messages with the bank via chat or internal mail;

- make payments at any time of the day;

- receive push notifications;

- upload documents in pdf format;

- create payment orders;

- issue invoices for payment;

- control receivables;

- receive all information about the status of accounts.

How to stay safe

Among the documents required to fill out, review and sign, Alfa-Bank has developed extensive recommendations for the safety of working with your personal account.

Various system access roles can be configured for employee personnel:

- Only view account statements.

- Entering primary documents without the right to sign an electronic digital signature.

- Control function and digital signature of all documents sent to the bank, including payment documents.

This factor can be considered one of the key ones, since the user will maximally protect the company’s finances from intruders. Restriction of actions will be the best form of control over ongoing operations, especially if we are talking about a large organization, a large number of transactions and a large staff.

Internet banking from Alfa-Bank is a technological tool that is integrated into the digital environment, including in terms of interaction with modern cloud services. At the same time, its interface is extremely simple and understandable; even an inexperienced user will quickly master the option and the procedure for working in his personal account.

Alfa-Bank business online login albo link is a fast and convenient service for conducting remote payments. It occupies a leading position in serving budding individual entrepreneurs. Thanks to his work, the workload on financial institution employees was reduced, and banking operations were put in order and accelerated.

Alfa-Bank business online login albo link is a fast and convenient service for conducting remote payments. It occupies a leading position in serving budding individual entrepreneurs. Thanks to his work, the workload on financial institution employees was reduced, and banking operations were put in order and accelerated.

The service helps attract new customers with its convenience and ease of use. Grateful users recommend Internet banking because it does not matter for its use:

Additional benefits of the system:

Users of the service are legal entities, individual entrepreneurs, and groups of companies.

Bank capabilities

Alfa-Bank business online login albo link differs from other services in the provision of numerous services.

The main capabilities of clients are reduced to the following list:

The main capabilities of clients are reduced to the following list:

Connecting the system

Before you start using the Alfa-Bank business online login albo link service, you will need to meet the requirements for hardware and software. Basic conditions:

After the digital device is configured, it is worth taking the time to connect alpha business online albo login. This will take approximately ten minutes. But this will allow you to optimize financial affairs and accounting. Detailed description of the actions you will need to take:

Memo to alpha business client online login:

As you can see, the Alfa-Bank business online albo link service has many advantages. Additional information about it can be read on the page. Ukrainian businessmen are also not left without the use of high-quality Internet banking, which is provided by. In Russia, the choice of such services is wider; it is considered one of the best. A selection of articles on each of the above topics will allow you to obtain detailed information about them and make your objective choice.

Alfa Bank Business Online (ALBO) is a service that helps small businesses and individual entrepreneurs manage their accounts, conduct financial transactions, create company reports, convert foreign currency and other opportunities. To use the service, you just need to integrate into your Personal Account. In this article we will talk about an overview of the capabilities of your personal account, connecting to accounting programs and protecting personal data in ALBO.

Alfa Bank business online: getting started

For a “pilot” evaluation of the service, you can use its demo version. After checking the functionality, you need to gain access for the organization. It is possible only after opening an account with, with a message that the company wishes to use electronic services in paper form. The connection is made after the company’s authorized representative brings a package of documents from the company:

- Passport of the company's authorized representative (this can be the director himself);

- Power of attorney for him;

- A document that confirms the authority of the trustee.

The use of ALBO is available from the moment the director of the company (or individual entrepreneur) goes to a stationary branch of Alfa Bank and signs there an agreement on incorporation to the terms of use of Alfa Business online, with an application attached to it. During the application process, the client comes up with a login, which will be the main one for connecting to the system. Additionally, a contact phone number is indicated where SMS notifications with passwords for logging into the system and codes will be received.

This is important to know! When you contact Alfa Bank support service by phone, you will be asked to provide a code word. If you did not receive it via SMS, or forgot it, then you will not be identified as an employee of the company, and help may be refused.

After signing the necessary documents, an SMS message with a one-time password to log into the system will be sent to the phone of the company director. When working with a PC, he goes online, opens a browser and enters the address: link.alfabank.ru (this is the page with login data). If your temporary password has expired and a new and permanent password has not yet been created, you can call the support service by phone: 8 800 100 77 33 . A specialist will help you register a new password. However, to change the phone number where SMS will be sent, you will have to write or call the personal manager of the bank that services your account with Alfa Bank.

Requirements for ALBO users

Theoretically, all interested legal entities can connect to the system, but you should still familiarize yourself with the list of requirements. Access to the Personal Account is available to persons:

- Who are entrepreneurs with a turnover of up to 1,000,000 rubles;

- Private professionals who conduct individual practical activities (notaries, lawyers).

Other legal entities may use other programs developed for them. The following list of requirements is related to the operating system installed on their PC. Suitable operating systems: Windows version 7 and higher, MacOs or Linux. An entrepreneur must also have:

- Smartphone or other mobile device;

- Latest internet browser;

- Internet with high speed;

- Installed Adobe Acrobat utility.

How to log into Alfa-Bank account from a mobile device?

A modern person always carries a mobile device with him - be it a smartphone, tablet or a regular push-button telephone. It’s hard to imagine working without them - there’s the Internet, email services, instant messengers, and access to important applications. This is even more important for a business person, since he needs to multitask. Tech utilities have influenced the development of online banking for mobile devices.

Logging into ALBO Alfa Bank is done simply from a personal gadget that runs on iOS, Windows Phone or Android. Downloading the application to access your personal account is available on the official market of the operating system installed on the smartphone. The functionality of the application is slightly less powerful than in the computer version, but it helps to perform basic operations.

The limitation of service packages in the mobile version is due to the newness of the system, but it is going through the stage of refinement and updating. Soon its capabilities will expand. You can log in to the program in the same way as through a PC: just enter your username and password in the empty fields. To speed up system performance, automatic entry of an access code received via SMS is available.

How to log into Alfa Bank business online from a computer?

An individual entrepreneur will be able to manage his assets from a personal computer, anywhere and at any time of the day. It is enough to be a client of Alfa Bank and subscribe to the basic service package. “Alfalink”, as a personal account access service for an entrepreneur, operates free of charge, and is consistent with the policy of distributing a virtual solution among clients of this institution.

There is a difference with the Alfaklik system: here registration must be completed at a customer service branch. Changing the password is available manually. Login to Alfa Bank business online is done from a PC, on the official page of the Internet portal of this system. The empty fields indicate the login and password specified in the contract. A message with an access code will be sent to your mobile device - this is the main security scheme during activation.

A user who logs in for the first time must change the primary password. Generate a new password and write it down in a secure notepad so you don't forget it. It must be specified when re-entering the program. It is recommended to set a complex, secure password that intruders cannot gain access to. Each time you log into Alpha Business online, you are required to enter a one-time code sent via SMS message. The bank client can replace this notification function with others:

- Send a one-time key to the company's e-mail. But this function also has its drawbacks - for example, in the speed of obtaining a code with the possibility of hacking an email account in an unauthorized way.

- Specify a special key using the eToken service. There is a fee for renting the service, but the method is very practical and compromise. It helps speed up login to the control panel and enhances the security of service.

PackagesALBO Link: price

After authorization in the service, you should understand the cost. Alfa Bank business online offers several packages for business, which differ in pricing policy, set of functions and the number of free transactions.

- “StartUp” package: 1090 rubles for 1 calendar month. The cost of one month of use with a one-time payment will cost 818 rubles. Payment transactions for assets of legal entities – limit of 5 transactions/month. free of charge, after the limit expires - 250 rubles.

- “Electronic” package: 1290 rubles/month, one-time payment cost – 968 rubles. The price of one payment to a legal entity’s account is 16 rubles.

- “Success” package: 2,300 rubles per month, a one-time payment will cost the client 1,725 rubles. The price of one payment to a legal entity’s account is free for up to 10 transactions, after the limit has expired – 25 rubles.

- Package "Alpha Business Foreign Economic Activity": monthly tariff - 3200 rubles, monthly payment for a one-time payment for the year - 2400 rubles. The price of one payment to a legal entity’s account is 30 rubles.

- “All inclusive” package: monthly tariff – 9900 rubles. The cost of a separate payment card for a one-time monthly contribution is 7,425 rubles. The price for a payment transaction to the account of a legal entity is 0 rubles.

Payments in Alpha Business online, video:

Alfa Bank business online - basic functionality

In the ALBO account, the user has access to various functions that support multitasking. The client can freely switch from one bank account to another within one window. This saves loading time and data processing speed. By working with several accounts at once, it is easier for an entrepreneur to control his assets, monitor the status of his accounts and simultaneously communicate with business partners.

After each operation the client receives a statement with all the operations performed, which also indicates additional parameters. The results are shown in a new browser window, or sent by email in the form of a table for printing. This way, the user does not have to waste time creating a report.

ALBO carries out importing and exporting 1C tables, working with them in the mode of different commands. This software extension will help a businessman manage his affairs while simultaneously performing basic work tasks.

In the service you can track the status of all your accounts, control replenishment and consumption operations. These operations work within a separate section and have a predefined sorting.

If you need to work with salary cards– the service will come to the client’s aid here too. Alfa Bank business online not only pays salaries to staff, but also sends data from the register to the servicing banking institution via a messaging system.

Thanks to this service, Alfa Bank client can work with foreign currency– buy it at a favorable rate. He will also be able to transfer money to residents of Alfa Bank, as well as to depositors of other banks. But the interest rate may change; you can find out about it from the customer support service, or on the information board of the official website.

"Cloud accounting"– a special service that allows you to process copies of all data, increase the level of data security, and copy them to other devices. To protect the company, they created a new security section - the LINK control panel. It allows you to restrict user access to certain company files or sections of the control panel, and generate accounts for logging into your company's accounting department. To learn about new functionality, you should subscribe to receive updates via email.

Working with accounting at Alfa Bank business online, video:

Integration with cloud services

Alfa Bank allows you to make payments and share statements of statements using high-quality cloud services. There are no additional fees or complex steps required to connect automatic data exchange to the system. This is done simply in a few steps:

- When the founder of a company fills out information about the company in online accounting, he confirms integration with Alfa Business Online Internet banking.

- Next, you need to go to the Internet banking settings, click on the “Alfa-Bank partner services” item.

- Select the “Online Accounting” option, which is currently used, and go to the “Service Management” page.

- Specify your online accounting login and sign the application for connection.

Which accounting services does Alfa Business Online work with:

- Finologist;

- My business;

- Sky;

- My warehouse;

- B2B CENTER;

- Outline accounting;

- Contour.elba;

- Bitrix24;

- Bukhsoft;

- Tensor;

- BUTTON;

- SEENECO.

Thanks to online accounting, you will be able to go in the right direction, and keep company records without errors, pay taxes on time, and send reports quickly via the Internet. It helps to create accounts, acts, contracts and invoices, and take into account income and expenses. Helps in maintaining personnel, accounting and tax protocols without the use of special knowledge and skills.

Alfa Bank business online customer support

Sometimes users have difficulty installing a mobile login application or logging in from a PC. For questions regarding difficulties, you can contact support:

- Make a call to the number +7 495 755 58 58 (across Moscow and the Moscow region);

- Telephone number for residents of other regions: 8 800 100 77 33 ;

- Technical support by email: [email protected];

- Create a letter in the Feedback Form on the page: https://alfabank.ru/feedback/support/

In the subject of the question, select the column “Individual entrepreneurs and small businesses.”

If serious technical difficulties or problems with passwords and access codes arise, it is recommended to contact the bank’s personal account manager.

Being one of the largest credit institutions in terms of the number of clients it serves, Alfa-Bank is interested in maximizing the automation of the process of interaction with clients - because this allows us to reduce the burden on bank employees, as well as streamline and speed up banking operations. For this purpose, organizations and individual entrepreneurs are provided with remote access to current account management through the Alpha Business Online service. At its core, it is a classic Internet bank for organizations, which can be used from any computer, provided that it is connected to the Internet and the user has an electronic key to encrypt the transmitted data.

Unlike many banks, Alfa-Bank refused to use client-bank systems that require the installation of a special program on the client’s computer for remote management of a current account. Such programs require large support costs both on the part of the client and on the part of bank employees. It is much easier to use Internet banking, and modern lifestyle dictates the need to control the account not only during working hours in the company’s office, but also on business trips or even on vacation. Therefore, in addition to the Alfa Business Online Internet bank, an application for mobile devices was created - Alfa Business Mobile.

How to start using Alpha Business Online

You can start using Alfa Business Online immediately after the head of the business (director of a company or individual entrepreneur) signs an application at a bank branch to join the rules for using the Alfa Business Online system (http://alfabank.ru/f/1/sme/alfa -business-online/Accept_Rule31032014.pdf) and the corresponding agreement (http://alfabank.ru/f/1/sme/alfa-business-online/dogovor27062014.pdf). In the process of filling out an application to join the rules, the client needs to come up with a login that he will use to log into Alpha Business Online, as well as indicate a phone number to which SMS passwords for logging into the system and a code word will be sent to receive support by phone .

Please note that service at the Alfa-Bank telephone support service is provided only by code word. If you do not know it or have forgotten it, then you will not be identified as an employee of the service organization, and you will be denied help.

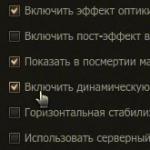

After all the necessary documents are signed, an SMS with a temporary password to enter the Internet bank is sent to the phone number specified in the application. The client just needs to open the system page in the Internet browser - link.alfabank.ru - and enter the login information. During the first session of working in the program, you will receive an offer to immediately change the temporary password to a new one, which must be created independently by the employee responsible for working with Alpha Business Online (manager or accountant). During further operation, the client can change the password for logging into Alpha Business Online if there is any suspicion of its compromise (menu “Settings” - “Change password”).

If you have exhausted the possibilities of using a temporary password, but were unable to register a new password, you can obtain another temporary password by calling the contact center at 8-800-100-7733. But to change the phone number registered in the system to which SMS is sent to you, you will have to contact your personal manager who is responsible for servicing your organization account at Alfa-Bank.

Opportunities of Alpha Business Online

The main competitive advantage of Alpha Business Online is cross-platform. This new word, in essence, means the ability to use any browser, any mobile device with the iOS or Android operating system to connect to the bank server. Many banks have limited capabilities of the Internet banking systems they use; most often, these services are “tailored” for one or two of the most popular browsers (usually only Internet Explorer), forcing the client to switch to using them. Alpha Business Online can be used both in the most popular Internet browsers and in rare ones.

Alfa Business Online is one of the most multifunctional online accounting programs among similar programs of the largest banks in Russia. But at the same time, it is also a fairly simple and convenient Internet application, even for inexperienced computer users. The main functions of Internet banking can be summarized as follows:

- making payments from the account of an organization or individual entrepreneur;

- “one window” mode for any number of accounts opened by a client with Alfa-Bank;

- information about account movements and balance in real time, with the ability to obtain such information “age” up to 5 years;

- import-export from 1C accounting program, export of data in Excel, PDF, SCV format.

- automatic data exchange with online accounting departments “My Business” and “”;

A unique feature of Alpha Business Online is the integration of the program with the popular online accounting systems “My Business” and “Accounting.Kontur”, the ability to work with them in a “single window” mode, with instant mutual data exchange. Thus, those legal entities that use these online accounting systems and, at the same time, have a current account opened with Alfa-Bank, receive a universal financial instrument for full-fledged accounting and payments, with the ability to actually automate such accounting and reduce the time spent on preparation and sending of payment orders, as well as other operations on the current account.

- combining several payments (up to 99) into a single register and simultaneously sending such a register of payments to the bank;

- compiling and sending salary registers to the bank with automatic loading into the Alfa-Bank banking system;

- the ability to make ruble transfers in favor of non-resident persons;

- the client can group several documents and immediately apply one operation to them;

- differentiate the level of access to program capabilities for different users.

Thus, Alfa-Bank's Internet bank - Alfa Business Online - is not only a multifunctional Internet bank for managing the current account of an organization or individual entrepreneur, but also an excellent means of attracting new clients to service the bank, thanks to its unique capabilities and ease of use.

Login to Alfa-Bank client bank: https://link.alfabank.ru/webclient/pages

Alpha Business Online system user manual:

Alfa Bank is one of the largest commercial banks. Its convenience and reliability have already been appreciated by several tens of millions of people.

In addition to a developed network of offices throughout Russia, the company offers convenient Internet banking Alfa Click.

Alfa Bank personal account features

Access to bank products and services is carried out using a mobile application or a browser on a PC. In Internet banking, the client can:

- control the movement of funds in accounts;

- transfer money to an individual or organization to a card or bank account;

- open time deposits and deposit accounts;

- find out the full details of a bank card or account;

- set up automatic payments;

- pay for popular services (housing and communal services, Internet, TV, mobile communications) and traffic police fines, state duties, etc.);

- make a currency exchange;

- connect or disable additional services;

- link a debit card to electronic wallets;

- block a bank card due to loss;

- pay a consumer loan or mortgage;

- apply for a new card.

Registration in your personal account Alpha Click

To register in the Alpha Click system, you will need a login and password, which is issued upon opening. If necessary, you can register using the phone number specified in the agreement, card number or account number.

Please note: when using a card number to register, you must also indicate its expiration date.

Login to your personal account

Login to LC Alfa Click is carried out in two stages:

- On the first one, you enter your username and password, and then click the “Login” button

- then you will need to enter the SMS code sent to the phone number specified in the contract.

Alpha business - login for legal entities

Owners of small and medium-sized businesses, when opening a current account, get access to separate Internet banking for corporate clients. The service allows you to conveniently manage various account functions. Login and temporary 30-day password are specified in the agreement for legal entities. After logging into your personal account for the first time, it is recommended to change the temporary password to a permanent one in the settings.

Alfa Bank Business (another name for Alfa link) allows you to carry out a number of the following operations:

- check the reliability of counterparties;

- create payment documents and templates

- use photo copies of documents to generate a receipt;

- make payments to individuals and legal entities from a current account;

- set up cash flow notifications;

- make currency payments;

- pay wages to employees;

- create integration with one of the cloud accounting services;

- upload payment orders and statements in pdf format;

- send letters and messages to the bank;

- pay taxes to the budget and the Pension Fund;

- quickly find the nearest office or ATM on an interactive map;

- control the receipt of funds from clients.

Password recovery for individuals and legal entities

There are 3 methods available in Alpha Click:

- In the login form, indicate only your account or card number and mobile phone number. A temporary password will be sent via SMS;

- find the nearest Alfa-Bank ATM, insert the card into the reader, enter the PIN code, select “Other operations” in the menu and follow the system prompts;

- contact the technical support operator on the hotline 8-800-2000-000.

For Alpha Business, there are two options for data recovery:

- submit an application at the nearest bank office;

- call business customer support at 8-800-100-09-11